Executive Summary & Recommendation

I recommend a long position in Howmet Aerospace (HWM – NYSE) on the basis that the business will

outperform consensus estimates on a sales and margin basis driven by a heightened demand in engine products in the industrial segment

My target price is $175 / share over a 2-year hold period, generating a ~25.5% IRR with a 4:1 risk / reward

- The drivers of idiosyncratic value are specific to:

- Data center energy demand and grid constraints will drive incremental outperformance in Howmet’s Engine Product sales in their Industrial segment

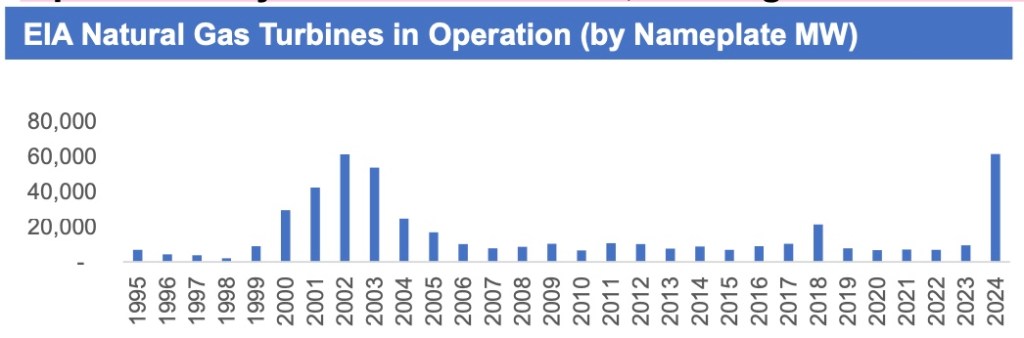

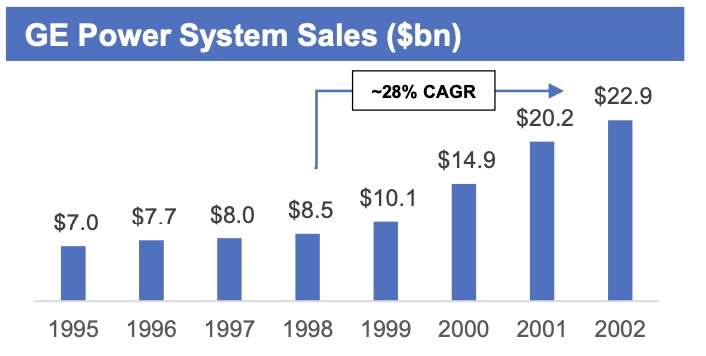

- Historical analysis of gas turbines in operation and GE turbine sales in 1998-2002 and 2024 uptick I turbine operations to support AI data center growth

- Given the lifecycle of turbines of 20-30 years, we are entering a replacement cycle driving an additional tailwind to unit sales as the bulk of turbine installations were installed during the internet boom 1998-2002

- Behind the meter (“BTM”) applications for data centers driving increased use of gas turbines due to grid constraints

- The Company has directionally indicated that this is a real tailwind but up until now has not quantified it so this could be driving a misunderstanding by the market

- Margin expansion in Engine Products segment from ‘26E – ’27E vs. consensus view of margin contraction by ~260bps supported by:

- Recent Engine Products incremental EBITDA margins over the past few quarters are in the 50%+ range well above current base margins of ~32%, so over time you can expect margins to ramp to these levels as favorable top line trends continue

- Data center energy demand and grid constraints will drive incremental outperformance in Howmet’s Engine Product sales in their Industrial segment

- I believe, over the near term, the market will come to realize this view as 3 main events evolve:

- HWM beats numbers over the next 6 quarters and further guidance from the company as customer demand evolves to support increased power generation necessities to bridge the utility gap

- Customers such as GE Vernova guiding up on gas turbine sales

- Increased dividends and share buyback programs with excess cash flow signal strong future performance

Key Assumptions and Considerations

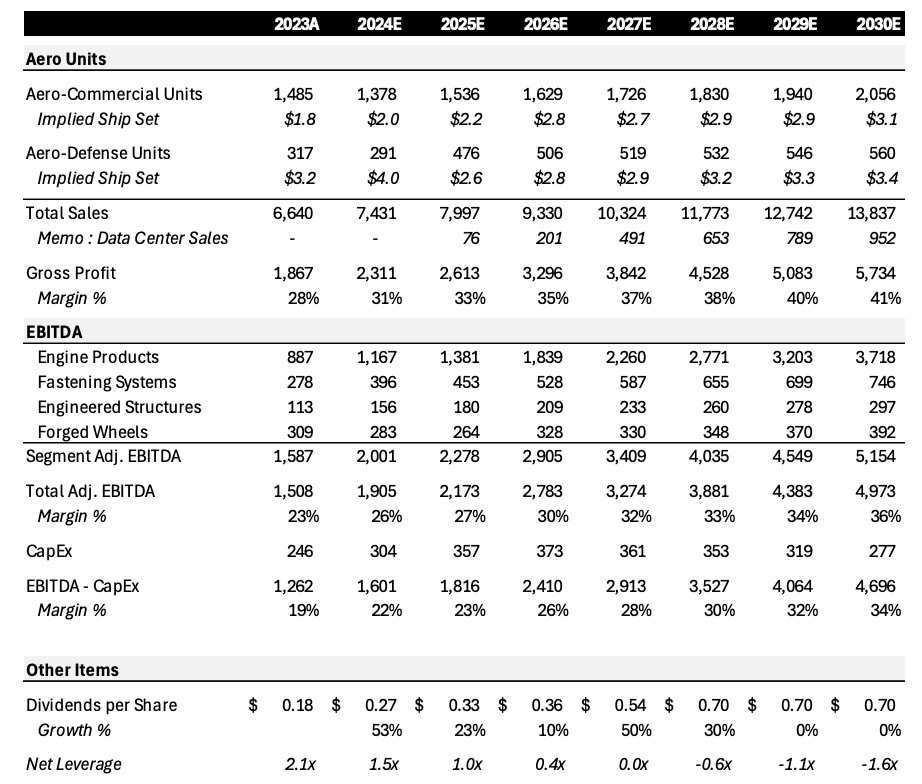

- Currently assuming consensus growth for all segments throughout my model except for the Industrial and Other segment

- Industrial and Other segment is driven by:

- 20% CAGR ’24E-’30E, a haircut to GE

- Power System Sales CAGR ‘98-’22A of ~28% on current base sales

- Additional data center BTM demand driving ~$490mm of additional revenue in ‘27E

- Assuming Aero and Transport Engine Products

- EBITDA margins grow at 2% annually after 2025E (in line with 3-year average annual margin expansion) and new Industrial sales are sold at 55% EBITDA margin (haircut to average incremental margins over past 3 quarters at 58%)

Industrial Gas Turbine Market Analysis

Gas turbine operations are beginning to inflect, in line with the 2000 internet boom while we enter a replacement cycle on turbine assets, creating secular tailwinds

Current EIA data shows the significant 500%+ jump in natural gas turbines in 2024, reflecting the prior peak in 2002, as the power grid became strained in the U.S., partly due to the rise of the internet. Gas turbines have an asset life of between 20-30 years, so assets will begin to be retired

- Gas turbine operation boom in early 2000’s drove new turbine sales, as evident in the hockey stick in GE gas turbine sales over the same period

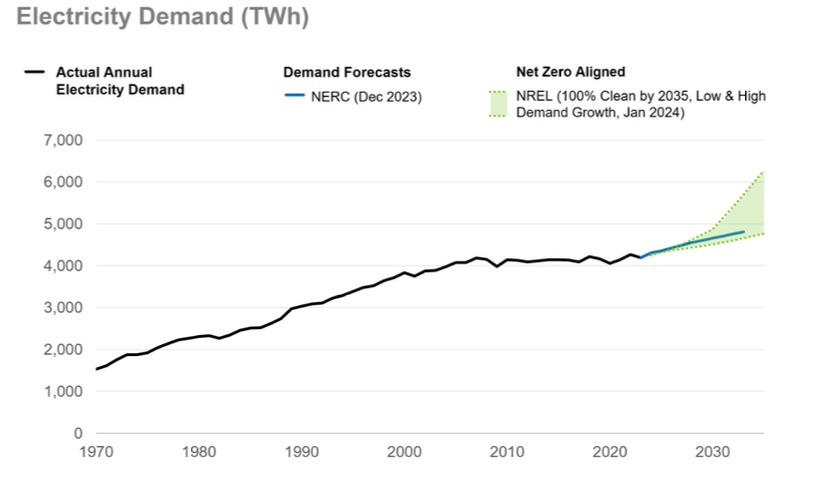

- The Electric Power Research Institute (EPRI) estimates that data centers could grow to consume up to 9% of U.S. electricity generation annually by 2030, up from 4% of total load in 2023. Data center consumption was ~1% of total load in 2000

- Estimates would outpace the rate of consumption growth in the early 2000’s

Industrial Gas Turbine Application Alternative Cost Analysis

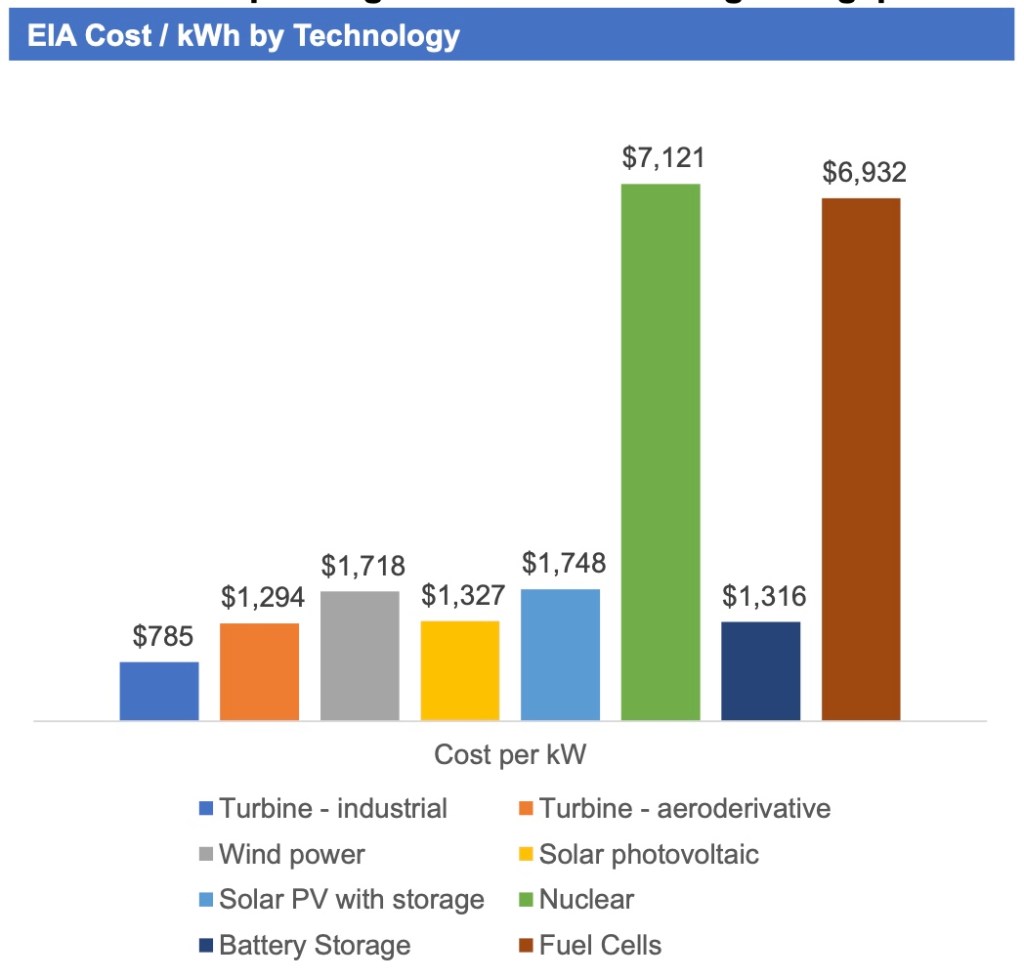

Natural Gas turbine cost / kWh is 65% cheaper than median cost of renewable alternatives, making it the winner in power generation as we bridge the gap in utility constraints

- Natural gas is a key energy source for booming US and global power markets, an emerging source in select transportation markets (e.g. China LNG trucking), as well as to meet industrial and other needs. Natural gas will be a critical power source for the foreseeable future

- Current alternatives including Solar PV, Wind Power, Fuel cells, and Nuclear produce power at a median cost premium of ~65% to gas turbines. Until these alternative renewable technologies come down the cost curve, gas turbines will be the outright winner in bridging the utility gap

Behind the Meter Application for Data Centers – a Burgeoning Model

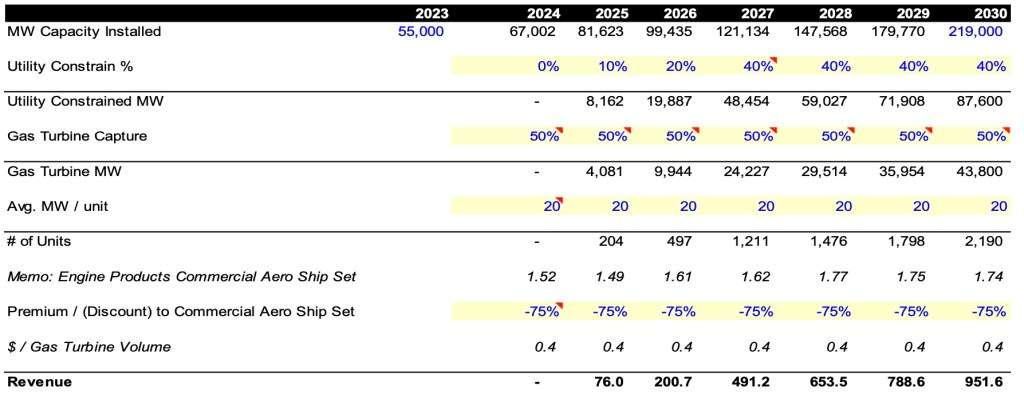

The model below isolates the impact to aeroderivative turbines for behind the meter data center applications and potential implied chipsets for Howmet

Recent Incremental EBITDA Margins Support Engine Products Margin Expansion

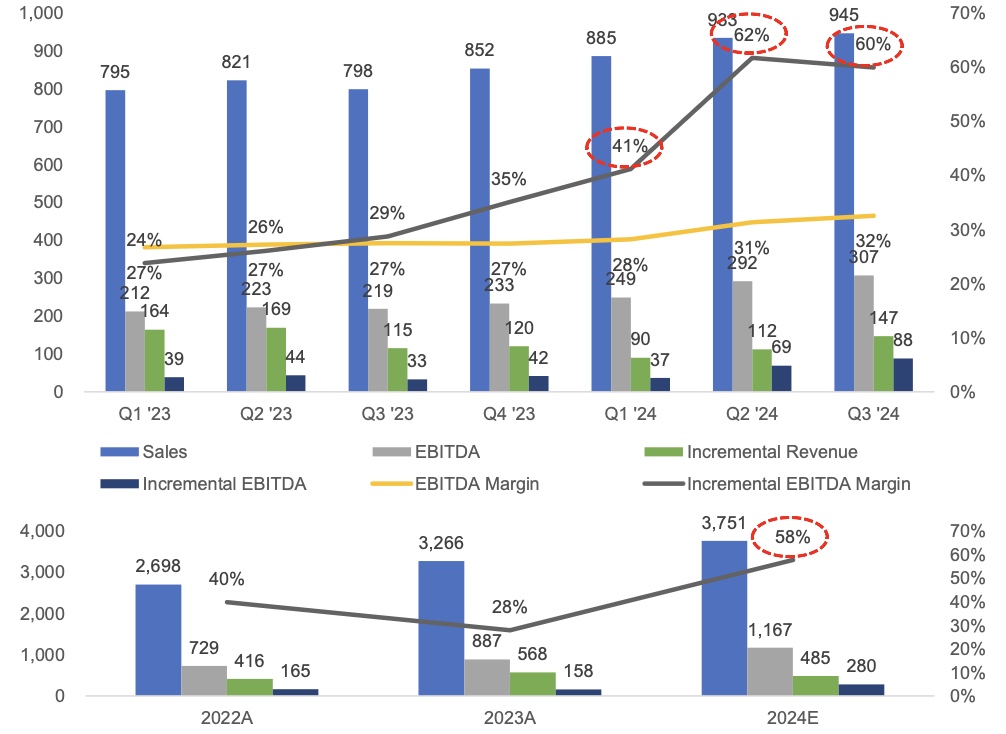

As the Industrial Segment drives outsized sales in engine products, the company should enjoy EBITDA margin expansion trending towards incremental margins over the past year

- Incremental margins have increased steadily over the past year, and assuming consensus margins in Q4, would generated EBITDA margins of ~58% for 2024E

- Incremental margins are 28pts above current base margins, supporting material upside in future EBITDA margin generation

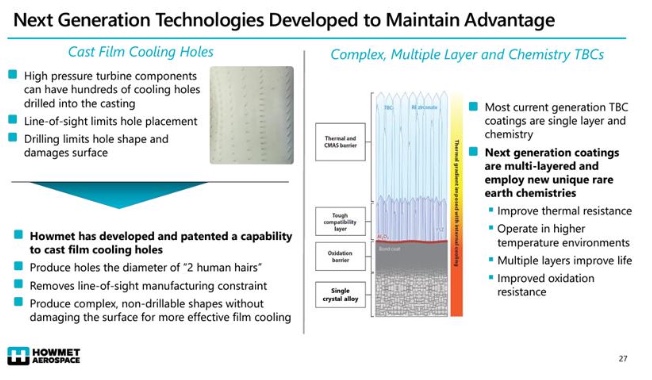

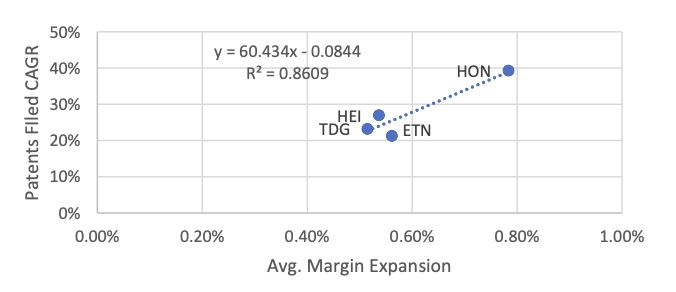

New Patented Technology Supports Economic Moat and Margin Expansion

Howmet hosted a Technology Day in 2022, highlighting critical blade technology (patented in 2014); the timing supports a potential timeline for commercialization and pricing effect

When looking at correlation of margin expansion and patent filing for key comps that also are levered to aerospace & defense, the R2 is 0.86 and implied margin expansion based on HWM’s patent filing is 30bps+; indicating expansion vs. contraction

IRR Analysis

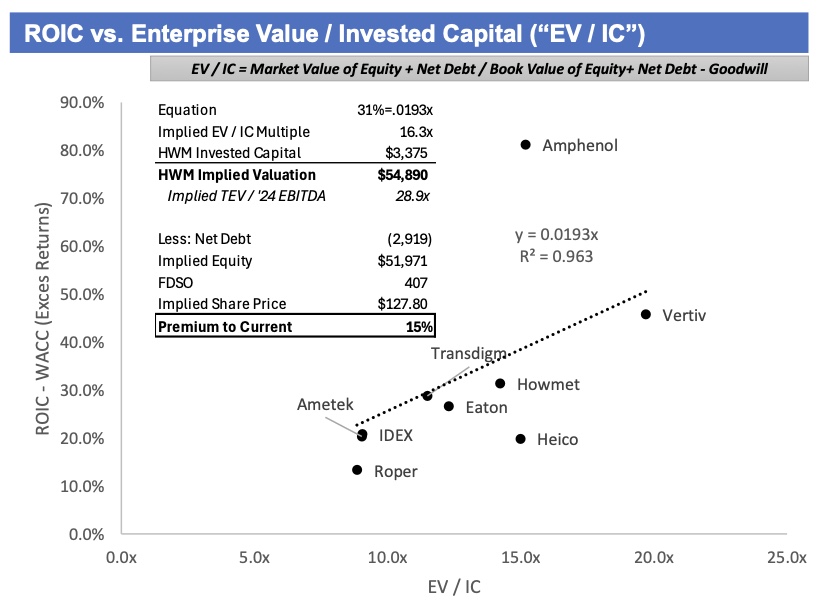

ROIC Based “Gap-Up”

ROIC and invested capital have a high correlation across top industrial compounders (R2 = .963) and implies a premium of 15% on HWM’s current valuation. As HWM continues to drive outsized topline growth and expand margins in line with the likes of HEI (ie. 2027E breaking into upper 20s EBITDA margin), investors will underwrite a similar long term cash flow profile.

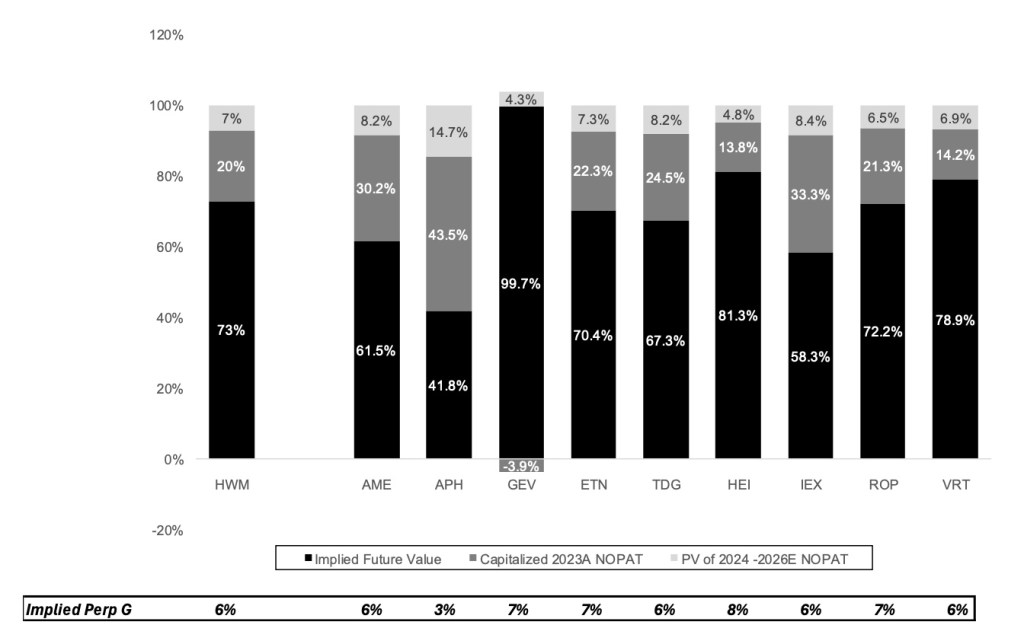

Capitalized Earnings Analysis

P&L Overview

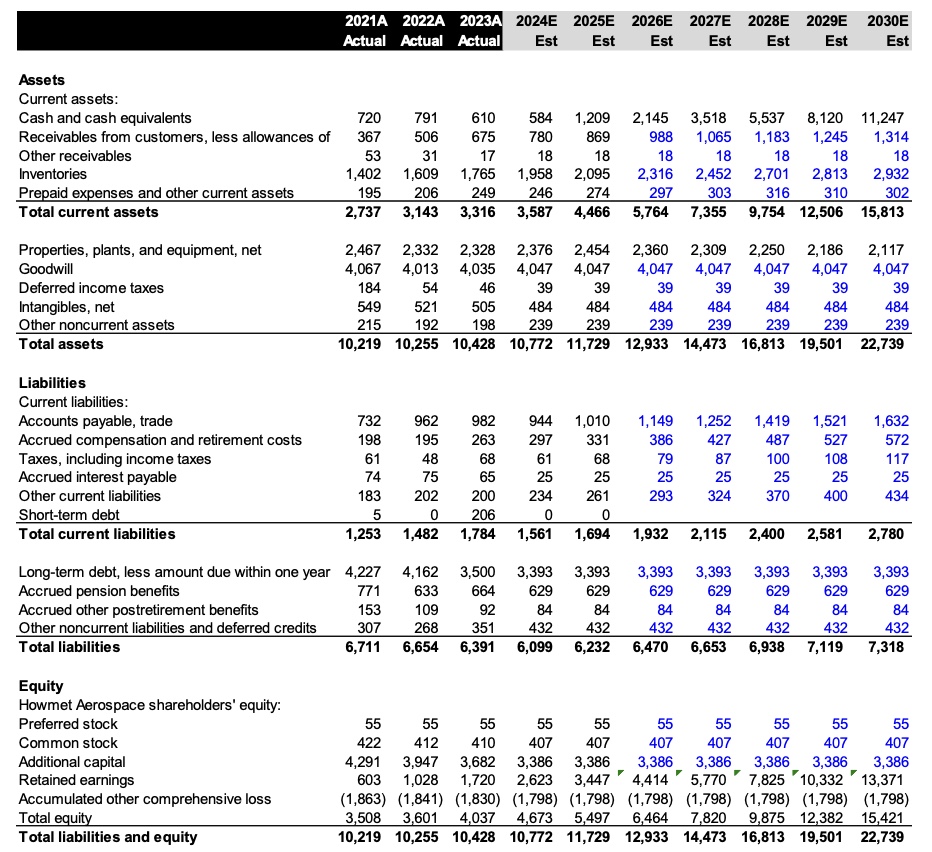

Balance Sheet

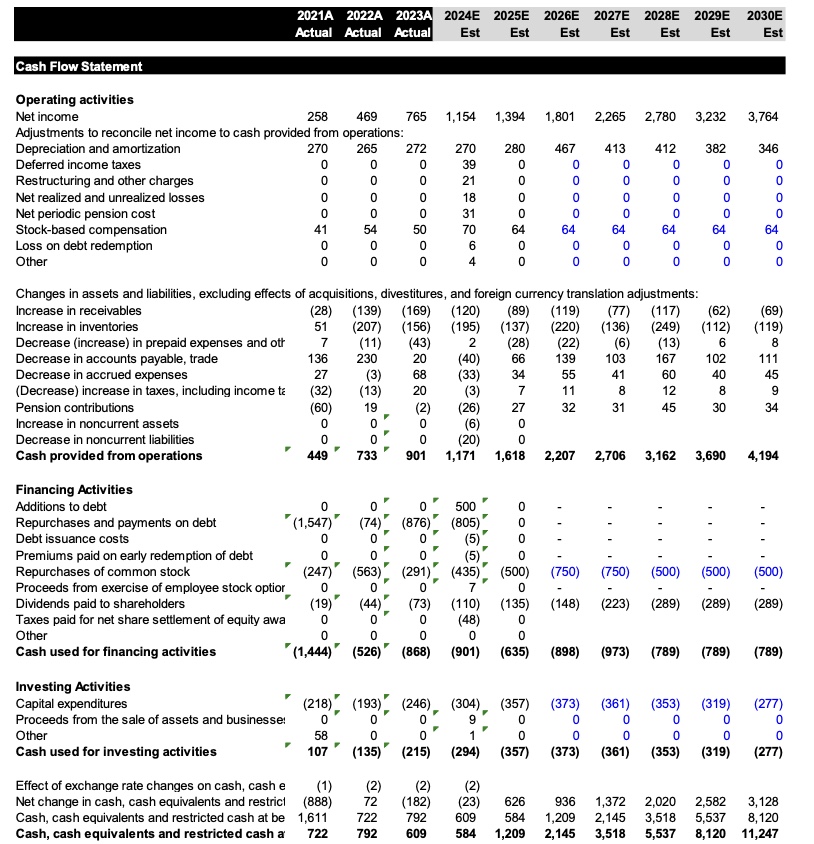

Cash Flow Statement

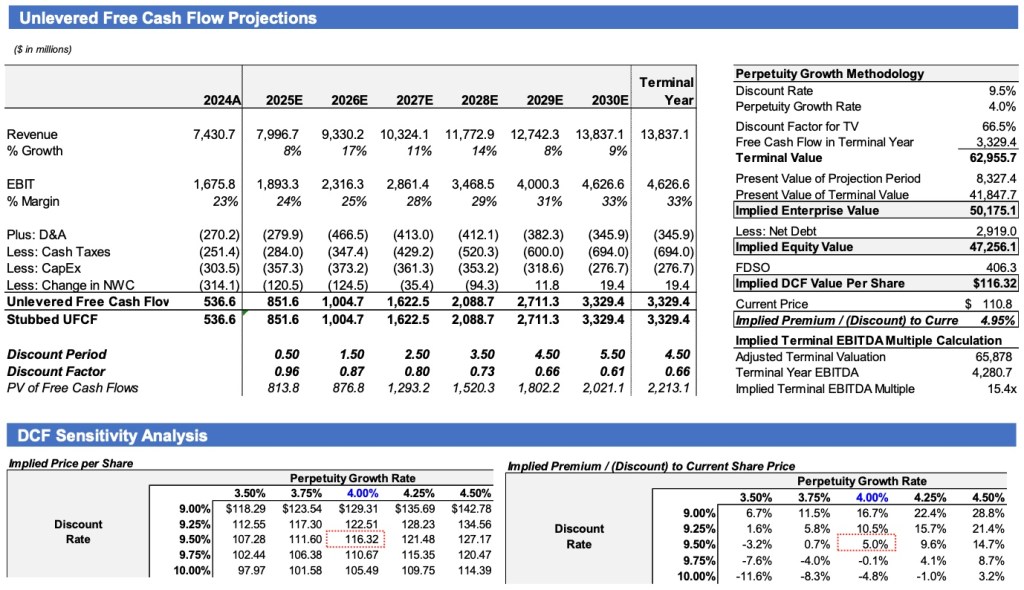

Discounted Cash Flow

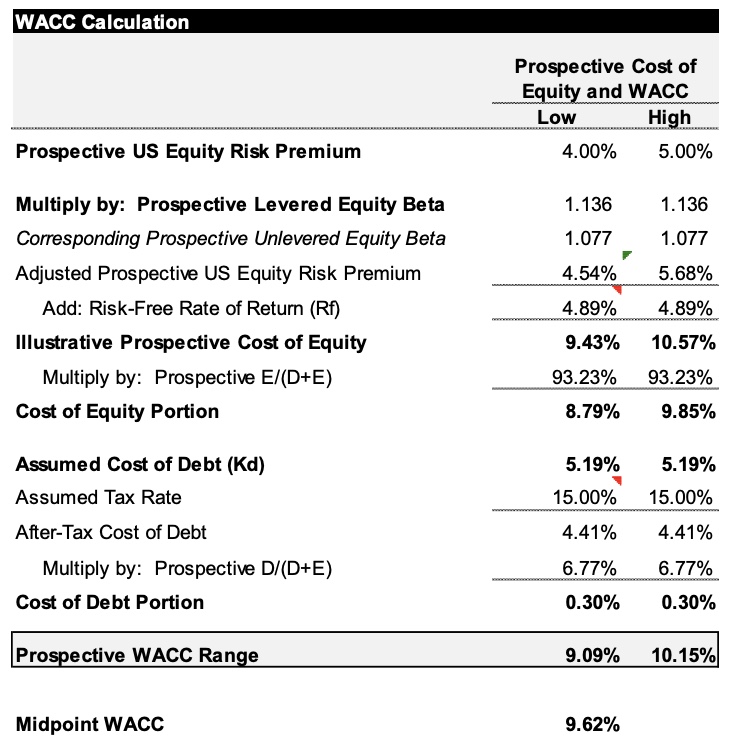

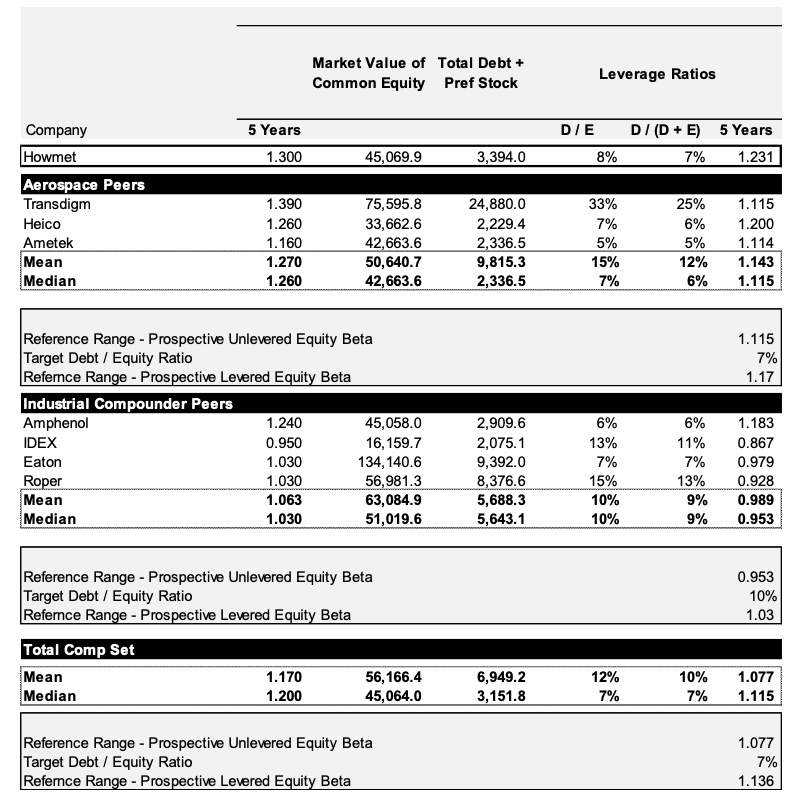

WACC Calculation

Beta Determination

Leave a comment