Recommendation and Thesis

Short-term: BUY WWD with a price target of $110.00 (~10% upside / <1% downside).

– Timing: ~1 month timeframe through the beginning of March (0.24% average 90 Day price change dictating downside).

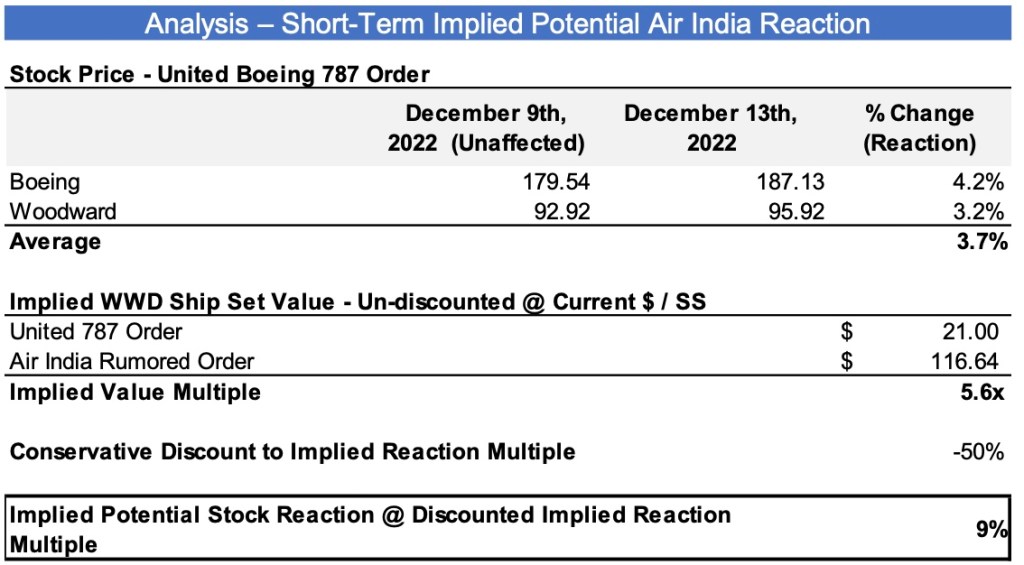

– Variant View: Air India has been rumored to place a ground-breaking ~500 unit order including 425 narrow-body planes (235 Airbus A320neo and 190 Boeing 737 MAX aircrafts) – although most of this value is likely baked into current forecasts, if you look at United’s December 2022 ~100 Boeing 787 order, Boeing’s stock jumped ~4% on the news and Woodward’s’ ~3%.

– Given this order is ~5x+ the value (on an un-discounted basis) based on current ship-set value for these platforms, I would expect Woodward’s stock to see a positive reaction.

– It was reported that Air India would make the announcement on January 27th, so the news could hit the tape any day now, so I am buying WWD in the short-term.

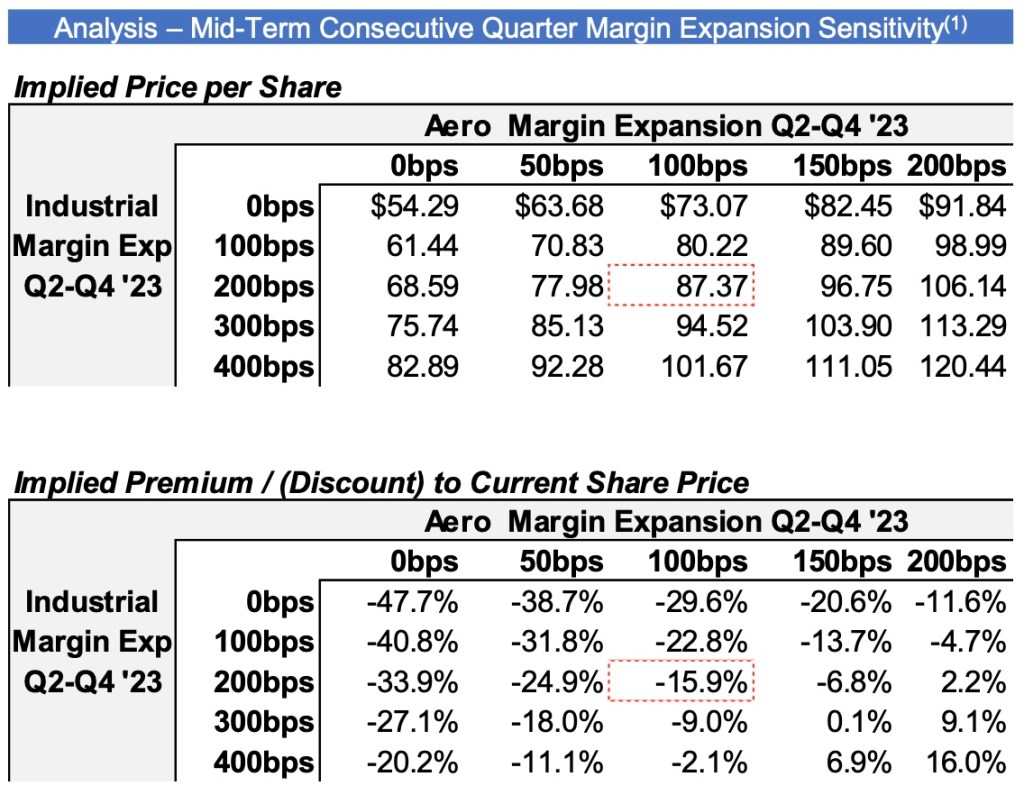

Mid-term: SELL WWD with a price target of $87.00 (~16% upside / ~48% downside) (see margin expansion sensitivity for up/down).

– Timing: March → May 2023, heading into Q2 Print in early May.

– Variant View: I believe WWD is well positioned for the long term, but in the short term I believe that the company has over-guided on margin expansion and will print FQ2 operating margins that track below guidance for the following reasons:

– Labor inefficiencies due to older workforce demographics of the business which has led to outsized cost growth (Aero margins this quarter ~14.0% vs. ~15.2% a year ago) with Aero sales up 18% YoY but margins declining ~150bps. In order to retain employees, they have also re-instated incentive comp (cut to $0 in FY2020 and FY2021, with minimal impact in FY2022, increasing in FY2023 to ~$60mm, paying higher wages for less efficient labor.

– China natural gas truck market – converting a trucks fuel system from diesel to natural gas drives demand for Woodward’s products – with China being shut down, there has been a significant drop in demand for parts on natural gas truck conversions, affecting Woodward’s industrial segment.

– They just restated guidance and they are implying minimal revenue for this reason, but they are guiding the full year industrial margin flat vs. 2022FY ~9.6% but just posted 5.1% Industrial operating margins for FQ1 with question as to how they will make up the ~450bps margin shortfall in the back half of the year given end-market dynamics and consistent internal productivity issues.

– Overall, I do not believe they will be able to hit their margin target with supply chain disruption causing shipments to slip and Woodward behind on price-to-cost dynamics, coupled with massive labor inefficiencies and an unclear picture on how they make up significant margin in the back half of the year especially on the Industrial segment side.

Leave a comment