Executive Summary

Current secular tailwinds, market and company fundamentals make cruise lines an attractive investment, with multiple drivers of outsized value and potential macro upsides creating long term value for the category

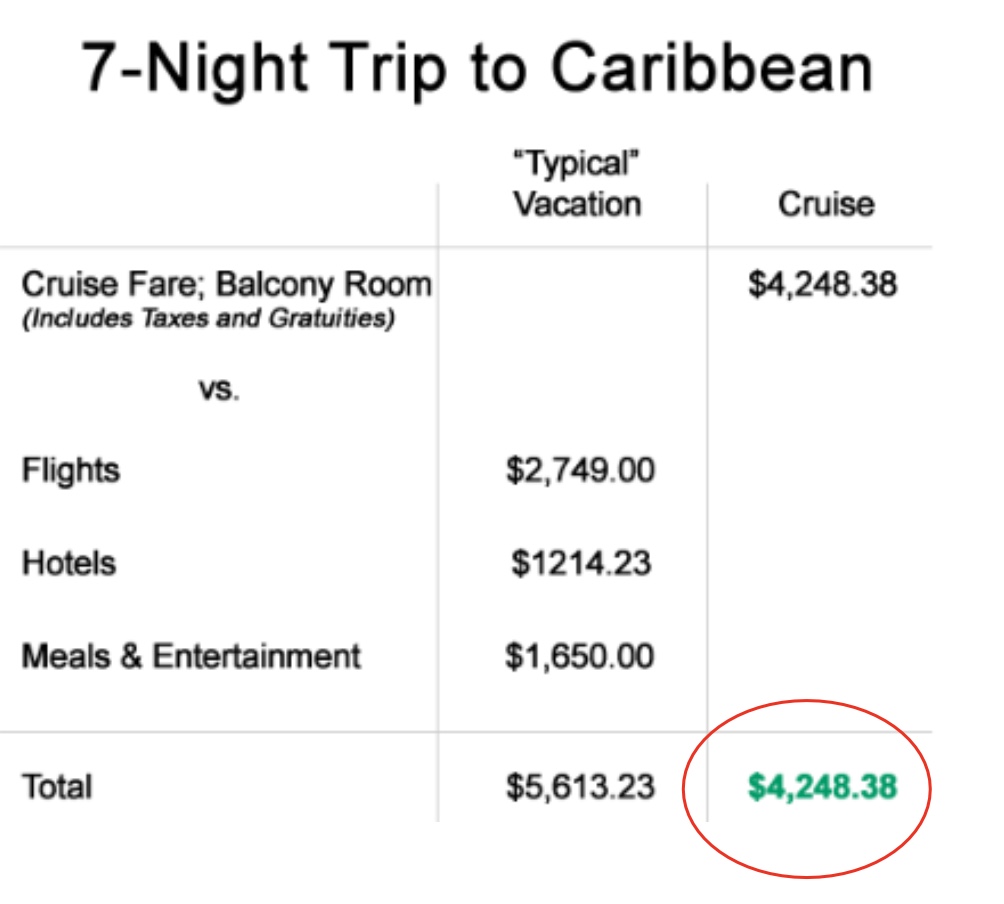

- Historically, there has been a deep discount to land base vacations vs cruising ~15%, with current discount ~25%

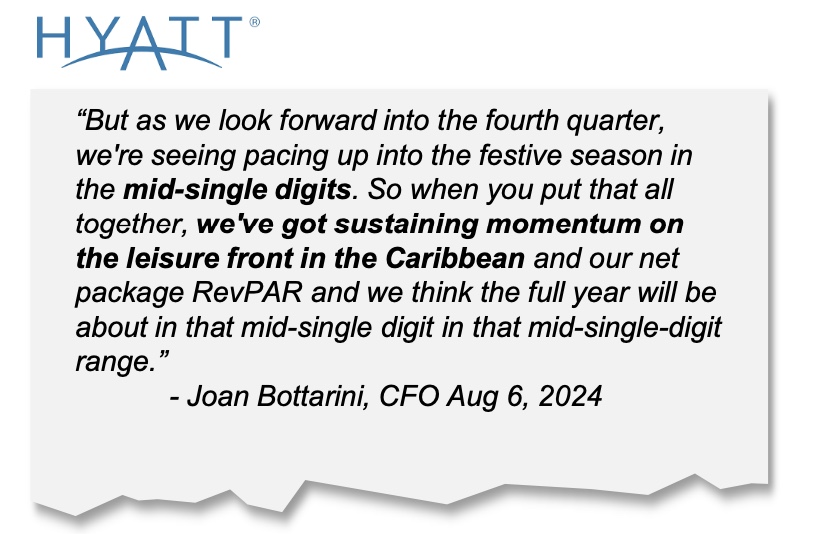

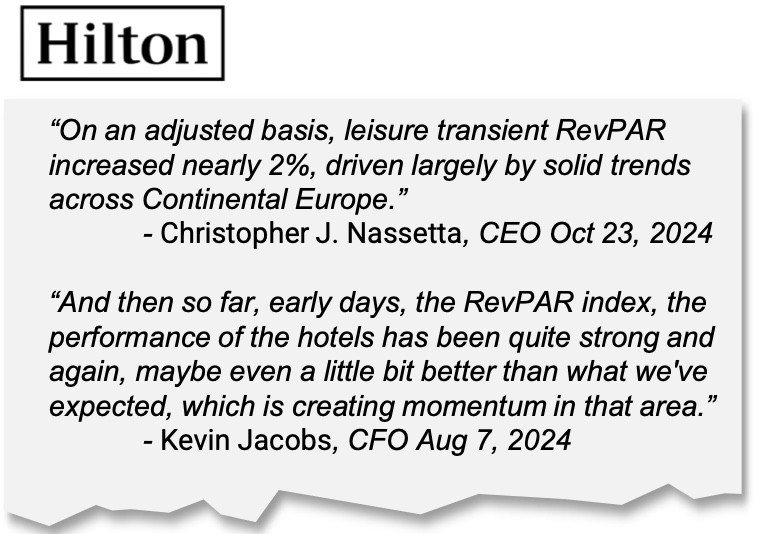

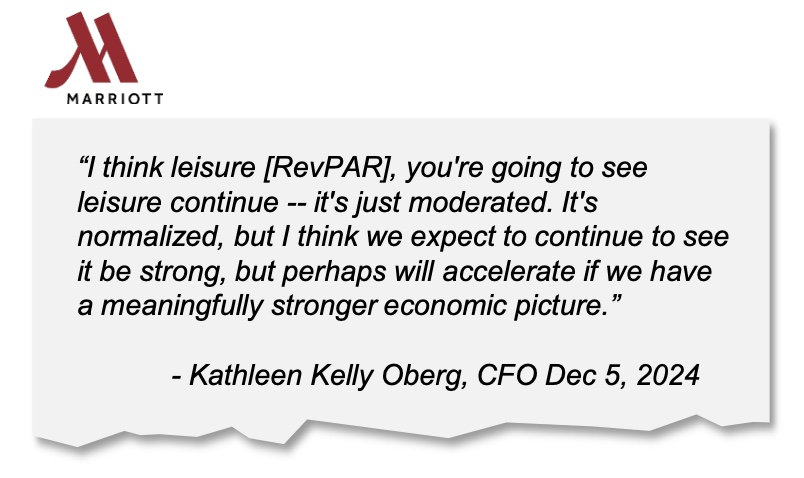

- With hotel operators signaling continued price increases, there is opportunity for outsized net revenue yields, supporting a

strong bull case for cruise lines

- With hotel operators signaling continued price increases, there is opportunity for outsized net revenue yields, supporting a

- Furthermore, cruise lines have begun to differentiate by adding destination islands (RCL Perfect Day at CocoCay, CCL Celebration

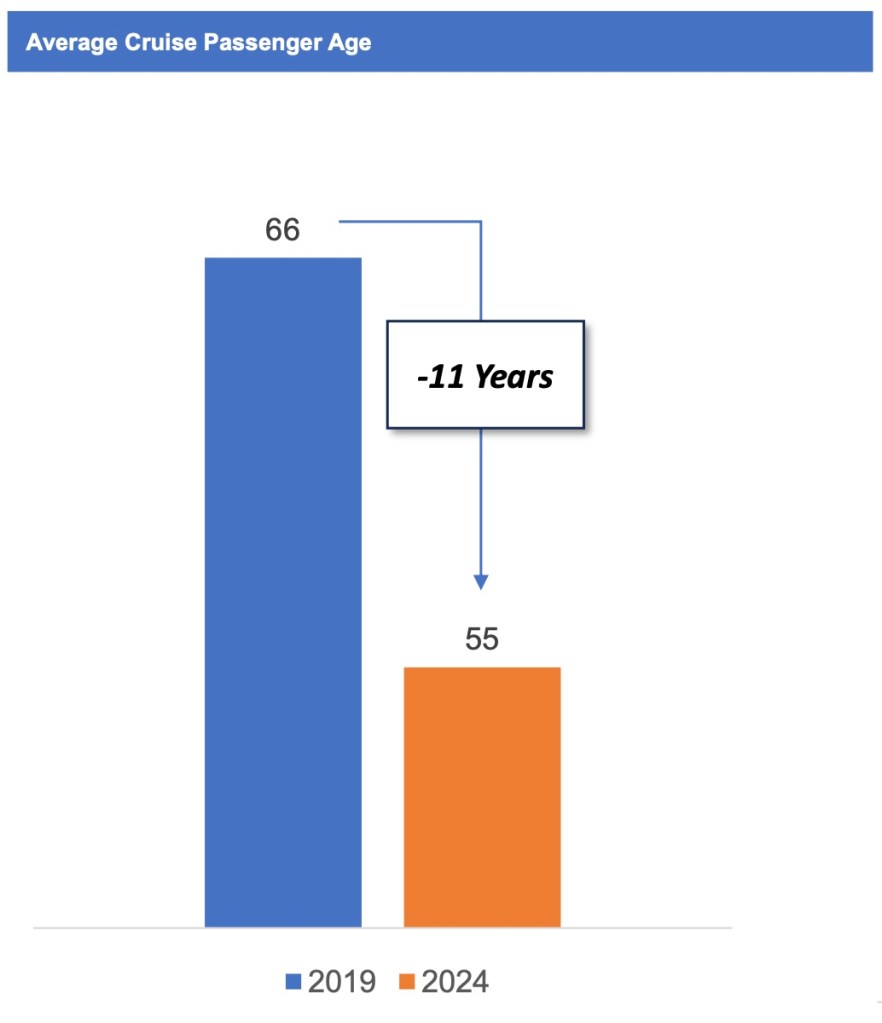

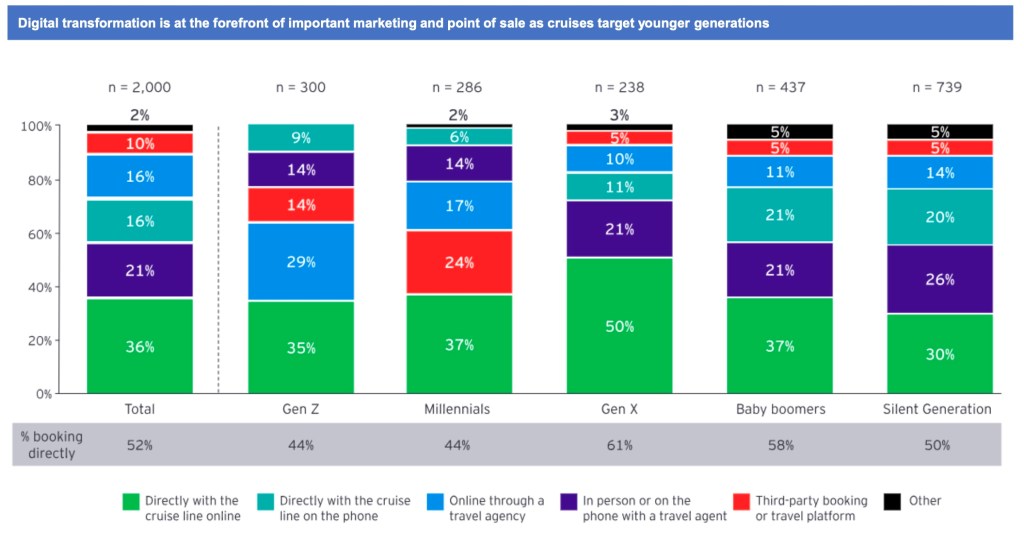

Key, NCLH Stirrup Cay) - Cruising overall has done a much better job marketing to millennials and younger and increasing the addressable market

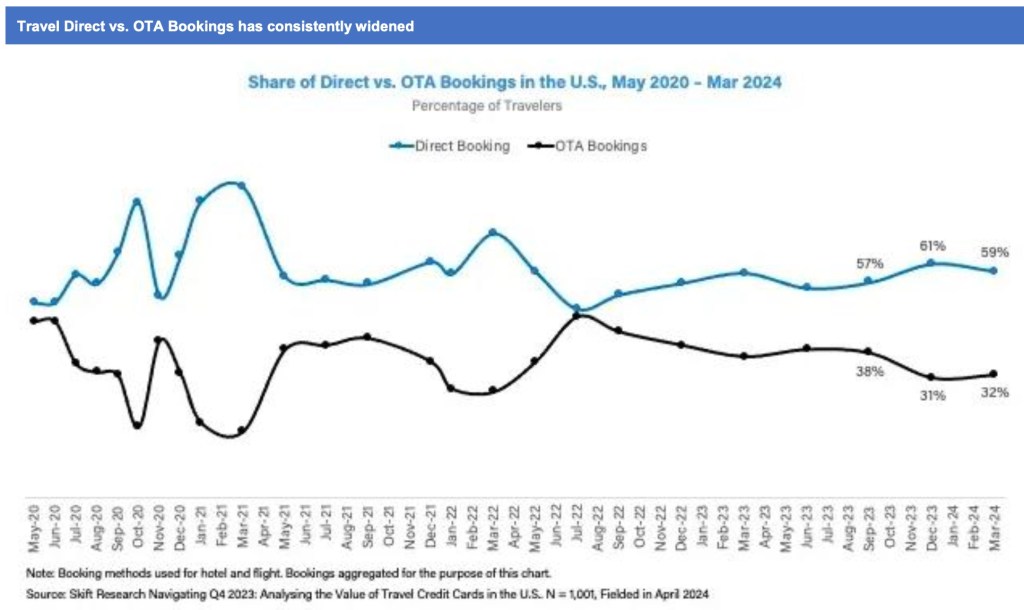

- As cruise lines attract younger generations as first-time cruisers, and repeat cruisers increasingly book direct, there is a multiple

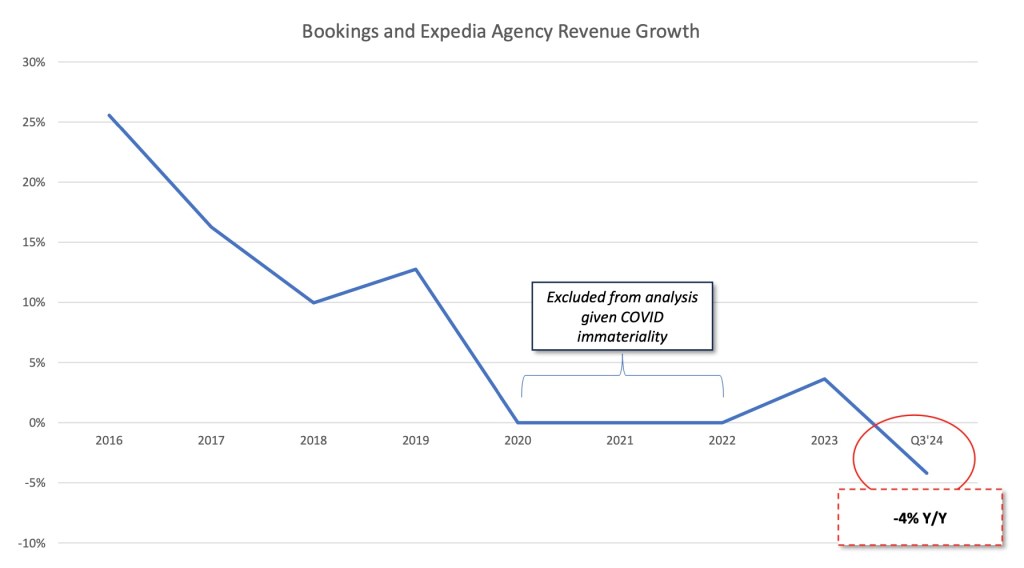

compound effect happening, whereby you have more tech-savvy customers enabling direct bookings at higher rates- For each ticker, I have broken out commission costs as a % of ticket sales (agency’s quote 5-10% of sale for commissions);

based on recent agency commission revenue trends from Expedia and Bookings Holdings, commissions are declining

precipitously - This creates a margin expansion effect across all names, which isn’t priced into consensus

- For each ticker, I have broken out commission costs as a % of ticket sales (agency’s quote 5-10% of sale for commissions);

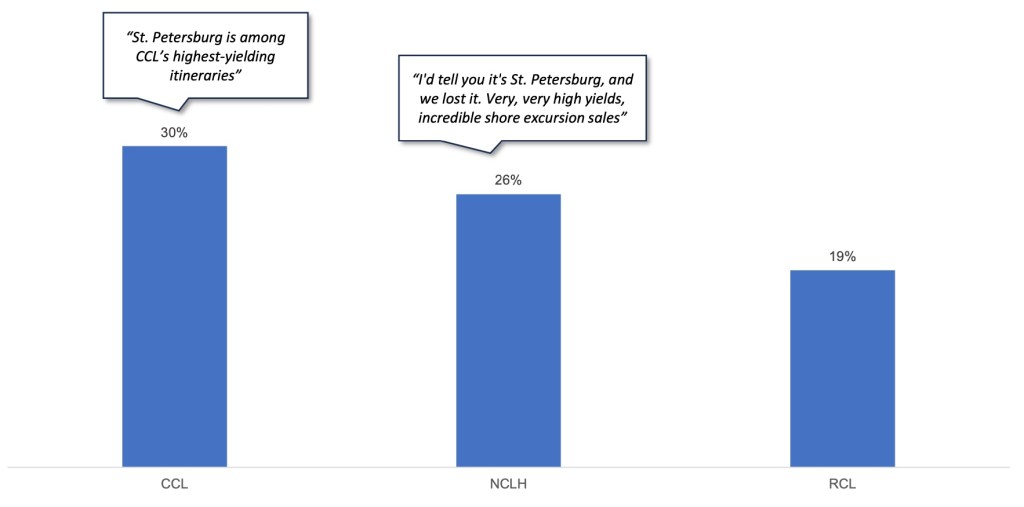

- Another tailwind for cruise lines is if the Russia / Ukraine conflict ends and St. Petersburg Port re-opens to cruises, which is a high-

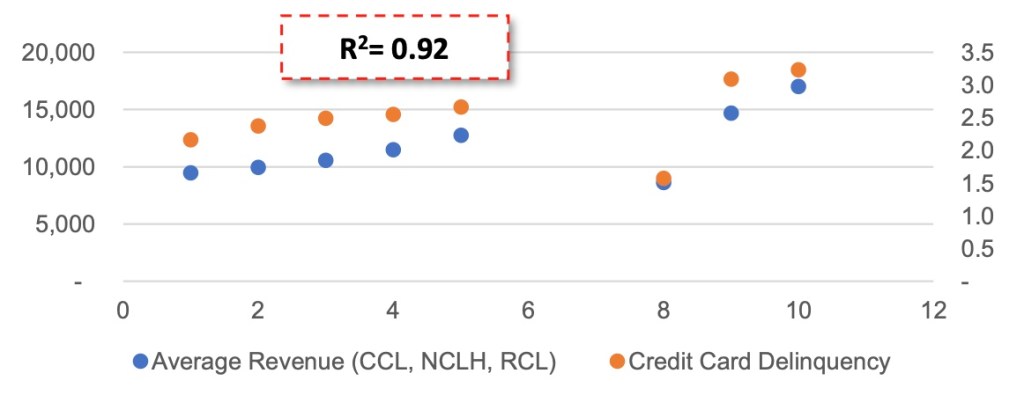

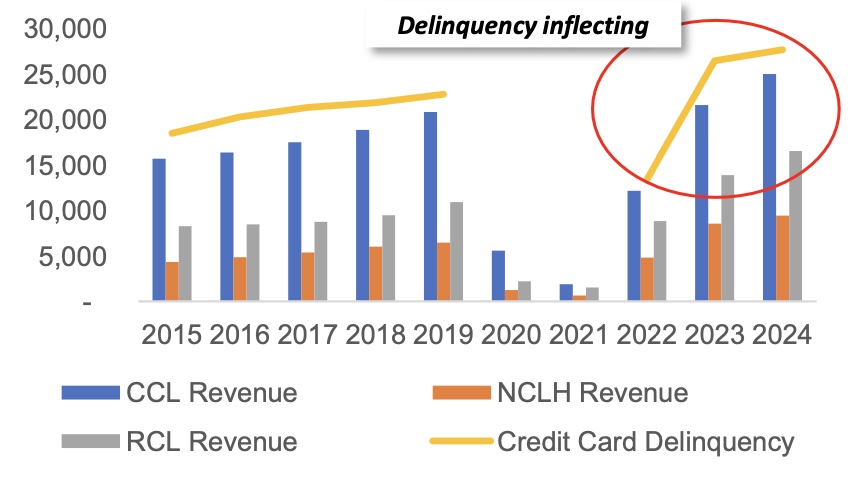

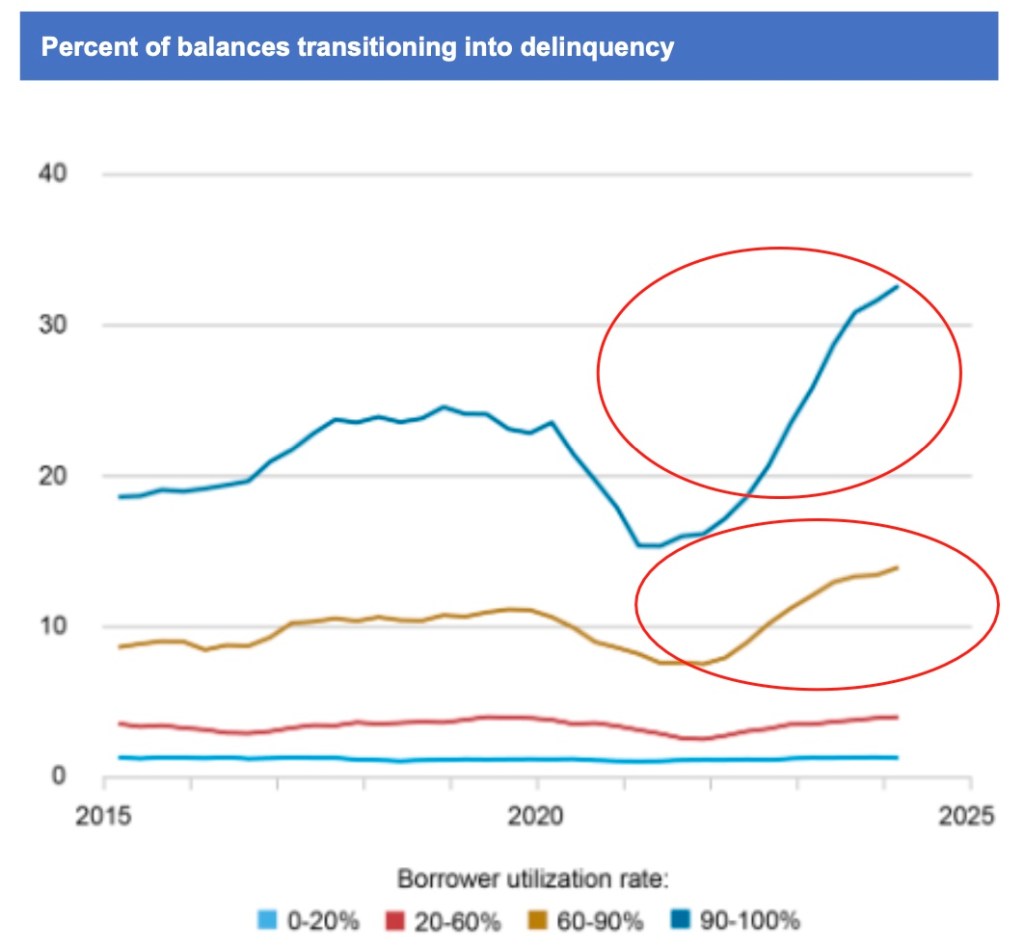

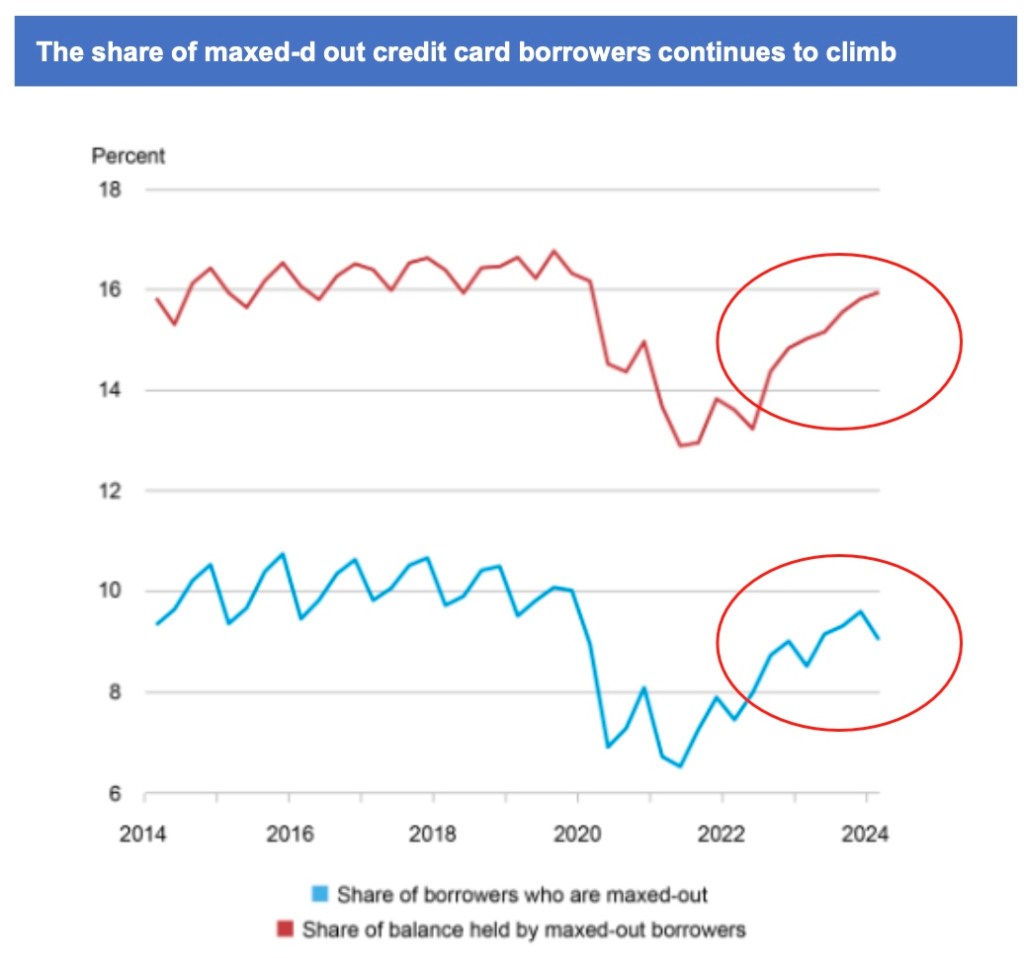

revenue yielding itinerary for Baltic cruise customers - Furthermore, with credit card delinquencies spiking and consumer debt growing at an increased rate, there is a “trade down” effect,

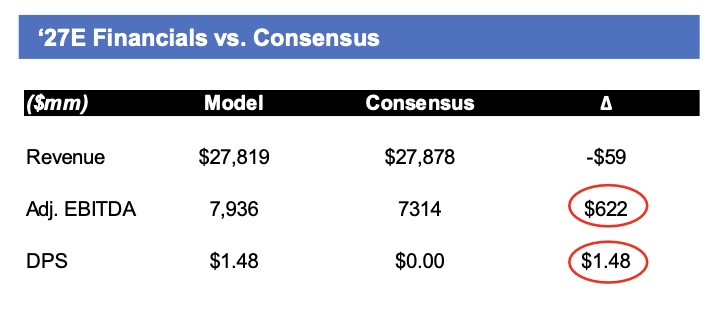

where customers tend to purchase more inexpensive services - As cruise lines continue to execute over the near term, current debt loads accrued during the COVID pandemic can be paid down to

levels where capital can begin to be returned to shareholders- Estimating CCL to re-instate their dividend in 2027E with net leverage in the ~2x range

- Estimating NCLH to instate a dividend in 2027E with net leverage in the ~2x range

- RCL already returning money to shareholders and planning an investor day in Q1 which they will lay out 3-year targets which

should positively affect the stock (likely to announce a large buyback program as well)

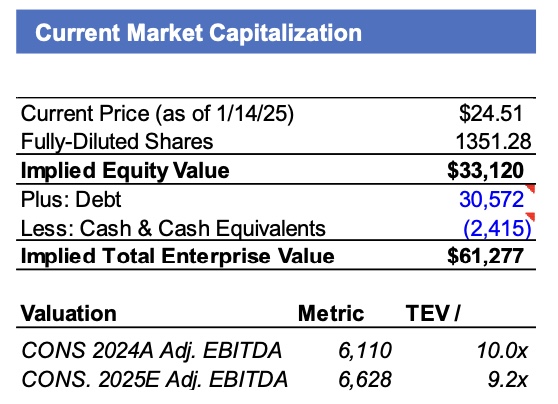

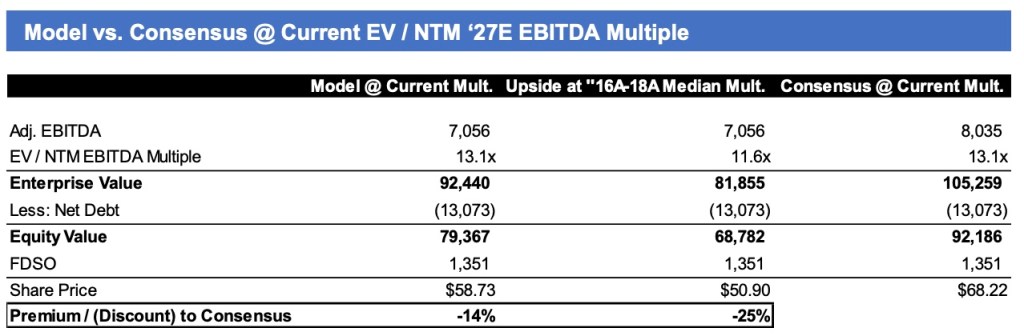

- Fundamentals, especially for lagging valuations in CCL and NCLH have the opportunity to gap-up to pre-pandemic TEV / NTM

EBITDA levels materially if they execute on leverage targets and return cash to shareholders

Macro Cruise Trends

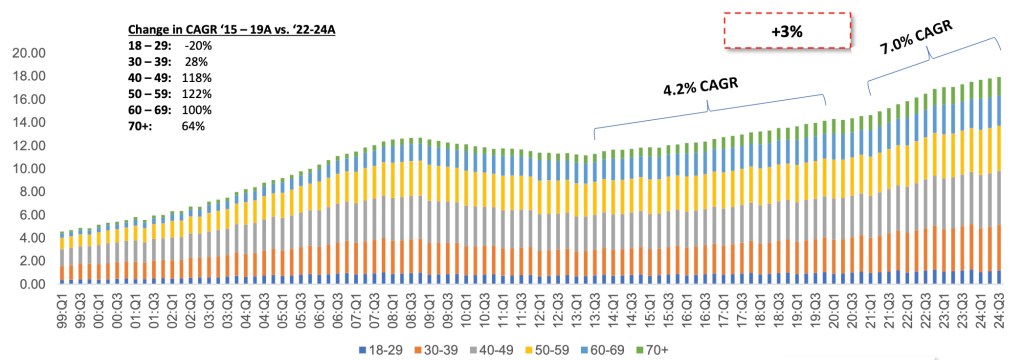

Debt Balance by Age Group identifies accelerating debt balances across 30-70+ year olds and Credit Card delinquency is highly correlated, pointing to a drive towards cheaper leisure travel alternatives as consumer liquidity continues to be a constraint

Maxed-Out Borrowers See Increasing Delinquency

Cruises Provide an Affordable Alternative as Consumer Debt Remains Elevated

In an analysis done for a 7-night vacation to the Caribbean for a family of 3, a cruise would approximately be ~24% cheaper

Strong Secular Demographic Tailwinds

Cruise Lines are Attracting Younger Generations and More First Time Cruisers

Direct vs. OTA spread Bookings Drive Higher Margin Sales

High Direct Bookings Across Generations

Saving on commissions boost net per diem revenues, and one way to do that is to increase directbookings

Online Travel Agency Revenue Growth Declining Significantly

Strong Hotel RevPAR Growth Support Continued Ticket Pricing

Hotels like Hilton, Marriot, and Hyatt have referenced continued pricing momentum, especially in leisure and international markets, pointing to strong pricing growth in cruises

Potential Upside for St. Petersburg Port Re-Opening

CCL and NCHL in 2019 had the largest exposure to European travel vs. RCL, and will be the greatest benefactors of Baltic Sea travel if Russia / Ukraine War ends and St. Petersburg Port

Preliminary Company Analysis

Carnival Cruise Lines

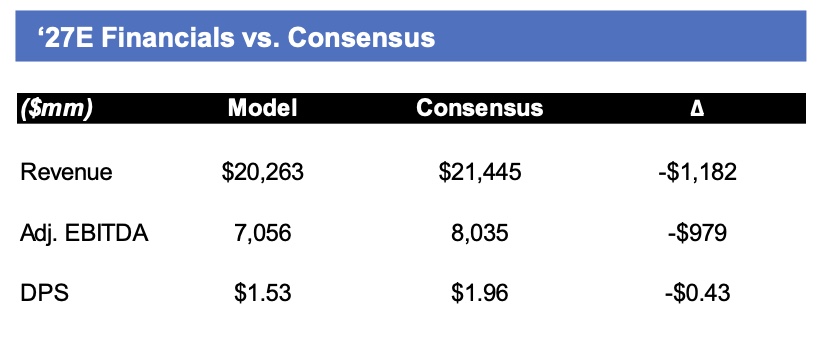

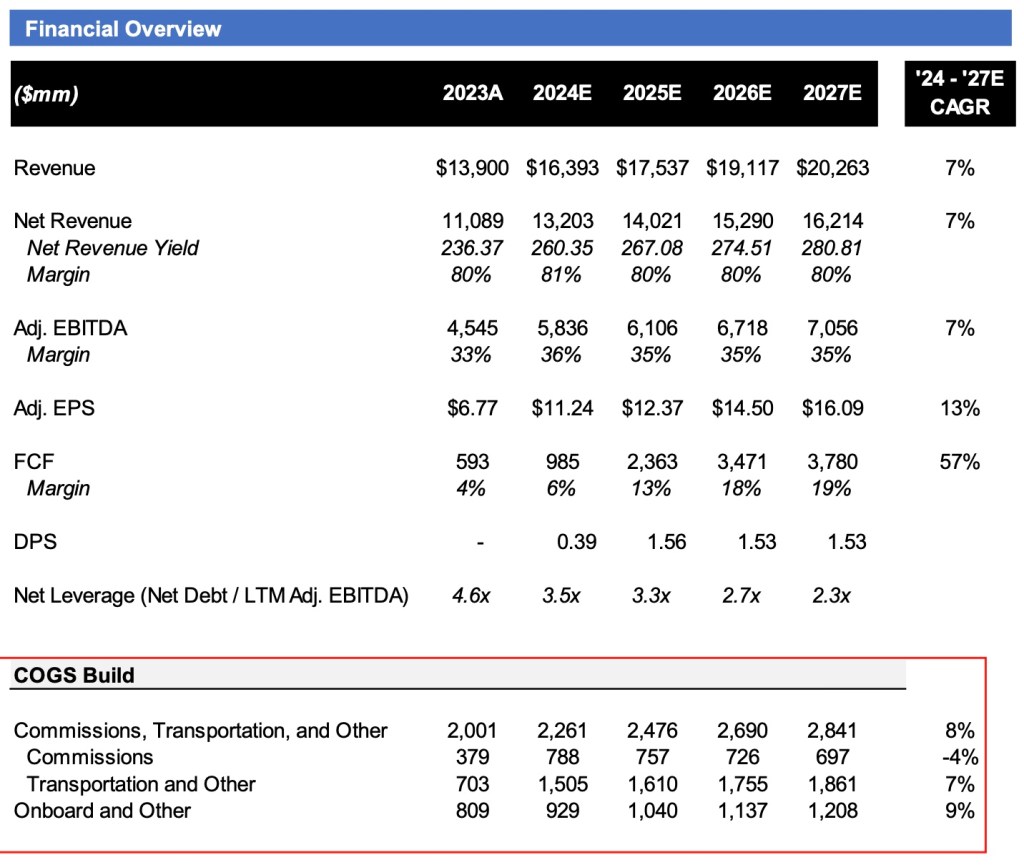

- Top line growing about in line with Consensus

- PAX ticket revenue = PCD * PAX

- Ticket / PCD

- PCD = ALBD * Occupancy Rate

- ALBD = Passenger Capacity (Berths) * Asset Utilization (Assuming quarterly utilization based on 2024 actual quarterly util)

- PAX Ticket / PCD growing at 3% – 2% p/a thru 2027E (haircut to current growth and in line with RevPAR commentary of continuous momentum in international markets)

- Onboard and other revenue / PCD growing in line with PAX tickets

- Assuming Commissions make up 25% of COGS ( or 7% of ticket sales based on desktop research) and assuming commission payments decline 4% p/a due to increased direct bookings and recurrence of younger generations booking direct

- Other COGS held at % of revenue quarterly 2024A

- All other OpEx growing at 4% p/a (inflation) , except for SG&A assuming corporate OpEx leverage, declining at 2% p/a

- ~$2.7bn debt payments due in 2026 and $2.7bn due in 2027

- Line of sight for leverage targets of ~2.0x to be met 2027=2028

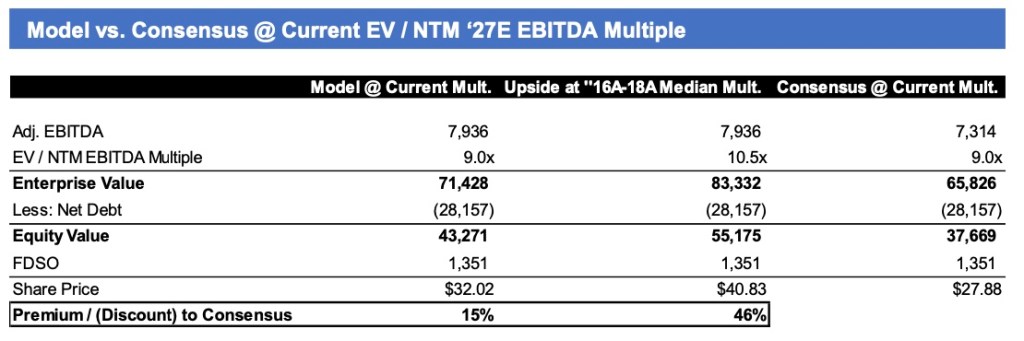

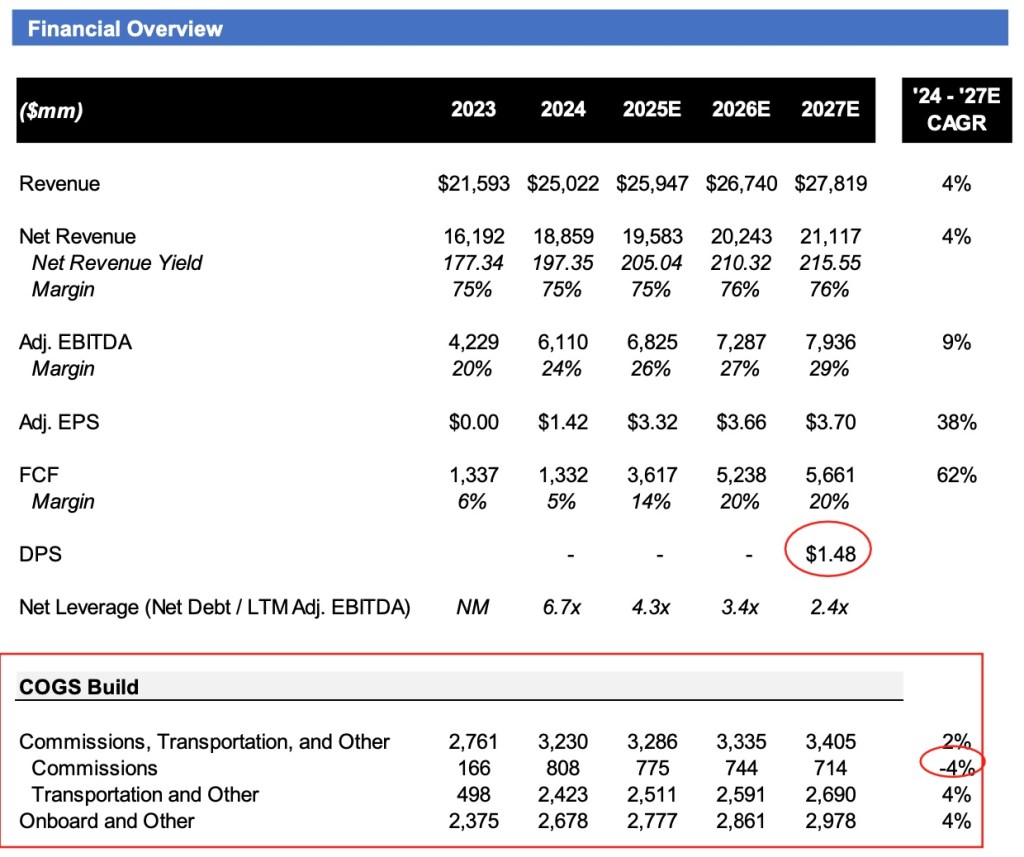

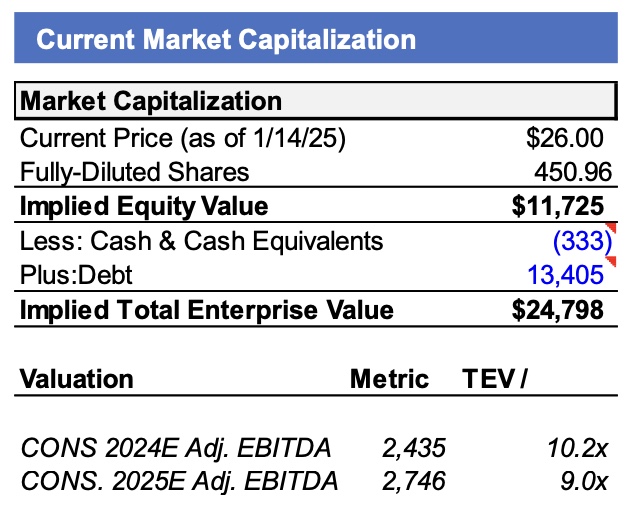

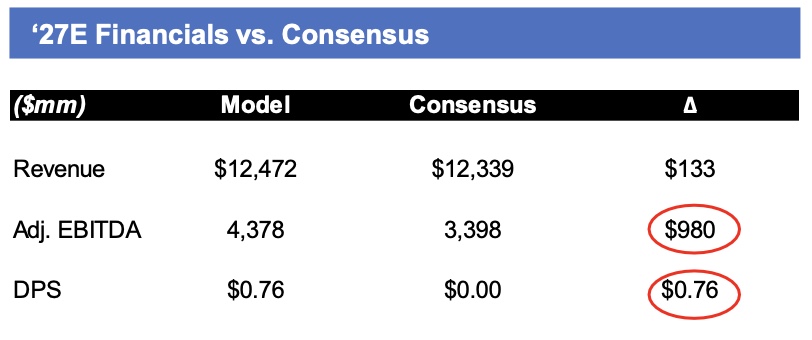

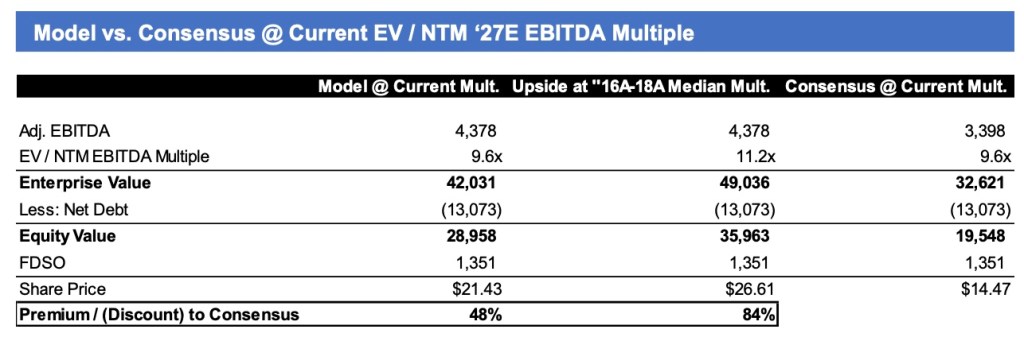

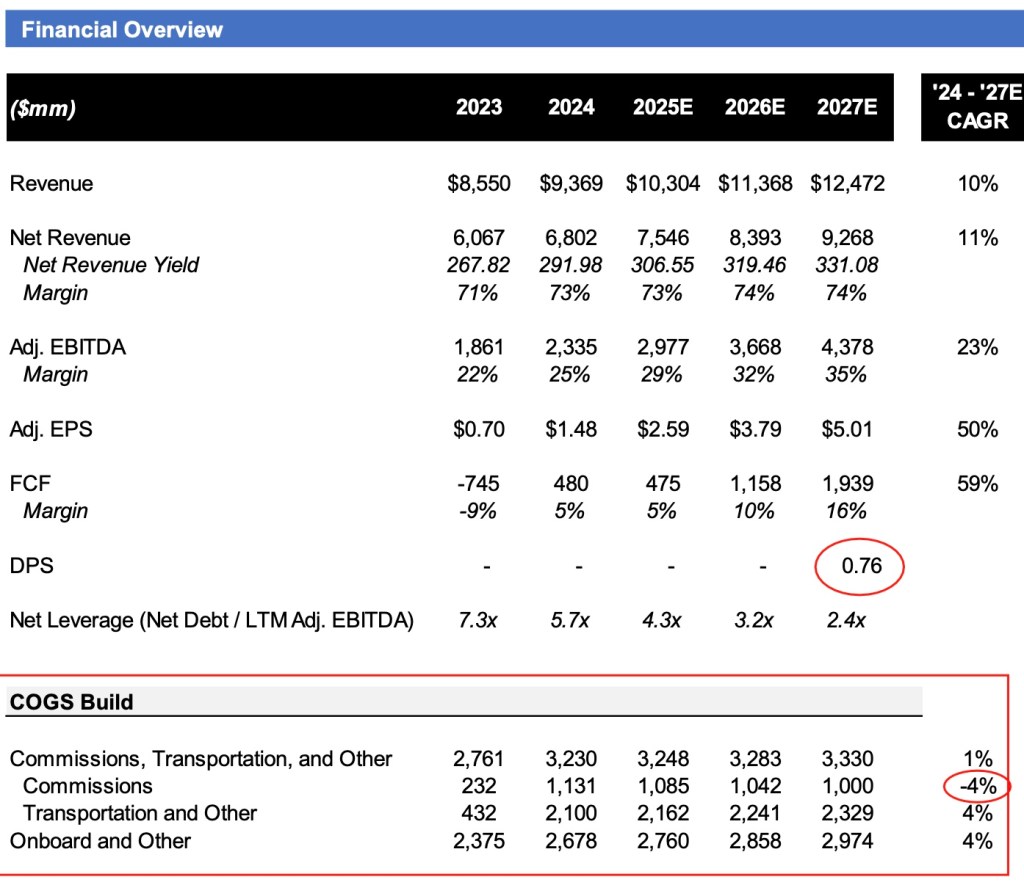

Norwegian Cruise Lines

- Top line growing about in line with Consensus

- PAX ticket revenue = PCD * PAX Ticket / PCD

- PCD = ALBD * Occupancy Rate

- ALBD = Passenger Capacity (Berths) * Asset Utilization (Assuming quarterly utilization based on 2024 actual quarterly util)

- PAX Ticket / PCD growing at 3% – 2% p/a thru 2027E (haircut to current growth and in line with RevPAR commentary of continuous momentum in international markets)

- Onboard and other revenue / PCD growing in line with PAX tickets

- Assuming Commissions make up 25% of COGS ( or 7% of ticket sales based on desktop research) and assuming commission payments decline 4% p/a due to increased direct bookings and recurrence of younger generations booking direct

- Other COGS held at % of revenue quarterly 2024A

- All other OpEx growing at 4% p/a (inflation) , except for SG&A assuming corporate OpEx leverage, declining at 2% p/a

- ~$2.7bn debt payments due in 2026 and $2.7bn due in 2027

- Line of sight for leverage targets of ~2.0x to be met 2027=2028

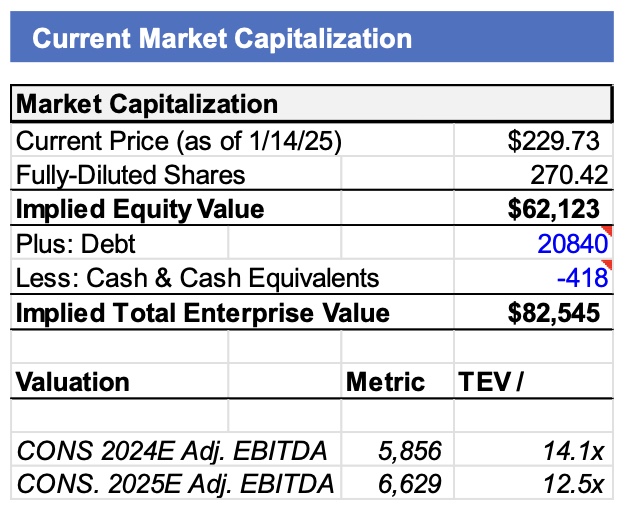

Royal Caribbean

- Top line growing about in line with Consensus

- PAX ticket revenue = PCD * PAX Ticket / PCD

- PCD = ALBD * Occupancy Rate

- ALBD = Passenger Capacity (Berths) * Asset Utilization (Assuming quarterly utilization based on 2024 actual quarterly util)

- PAX Ticket / PCD growing at 3% – 2% p/a thru 2027E (haircut to current growth and in line with RevPAR commentary of continuous momentum in international markets)

- Onboard and other revenue / PCD growing in line with PAX tickets

- Assuming Commissions make up 25% of COGS ( or 7% of ticket sales based on desktop research) and assuming commission payments decline 4% p/a due to increased direct bookings and recurrence of younger generations booking direct

- Other COGS held at % of revenue quarterly 2024A

- All other OpEx growing at 4% p/a (inflation) , except for SG&A assuming corporate OpEx leverage, declining at 2% p/a

- ~$2.7bn debt payments due in 2026 and $2.7bn due in 2027

- Line of sight for leverage targets of ~2.0x to be met 2027=2028

Additional Analysis

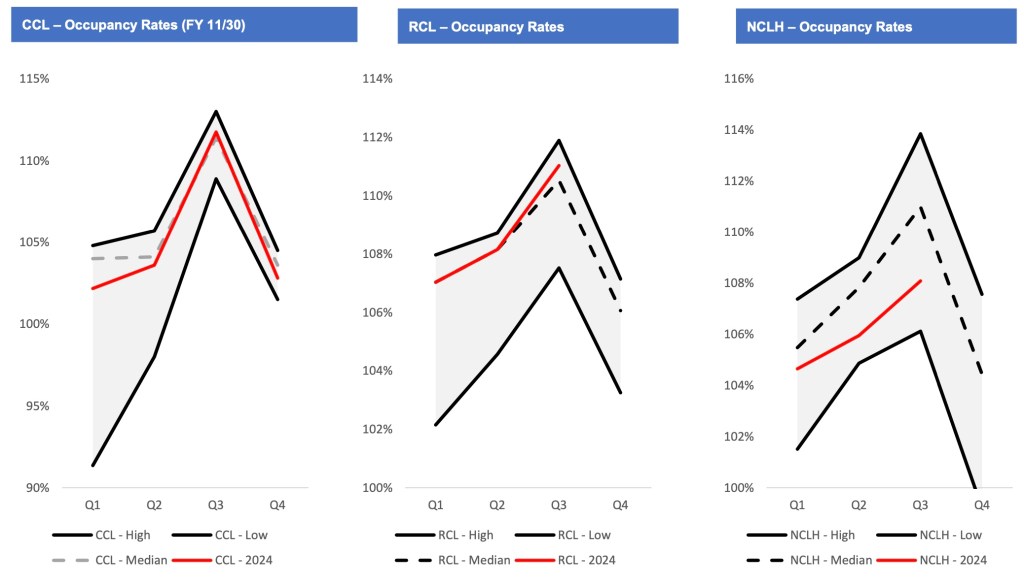

Occupancy Rates – 2015A – 2024A

CCL and RCL have demonstrated high occupancy rates above historical medians while NCLH has lagged in 2024

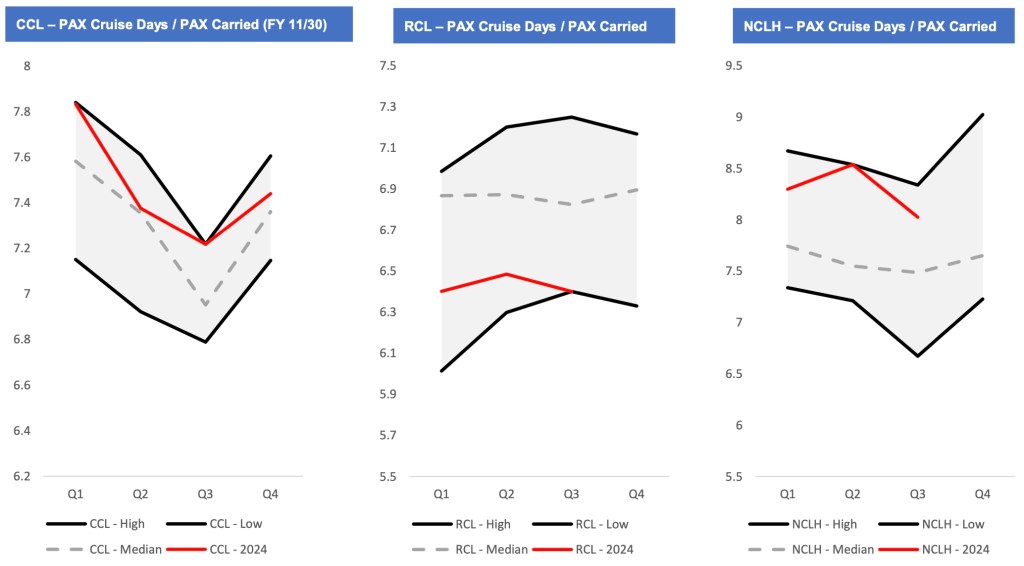

PAX Cruise Days / PAX Carried 2015A – 2024A

CCL and NCLH have consistently outperformed median days, with RCL nearing historical lows in 2024

Leave a comment