Executive Summary – Update on Shoals Position

Based on further analysis and absorption of Q3 ‘22 earnings, I have revised my thesis, and am proposing to short Shoals with a target price of $19.40 and upside of ~38%

- I have refined my model to reflect Q3 earnings and I have implemented material changes to my near-term forecast, but the fundamentals of my thesis remain intact

- Based on current business trends, Shoals has raised the low end of its outlook as follows:

- Revenue in the range of $310-325mm from $300-325mm

- Adjusted EBITDA in the range of $80-86mm from $77-86mm

- Adj. Net Income in the range of $48-53mm from $45-53mm

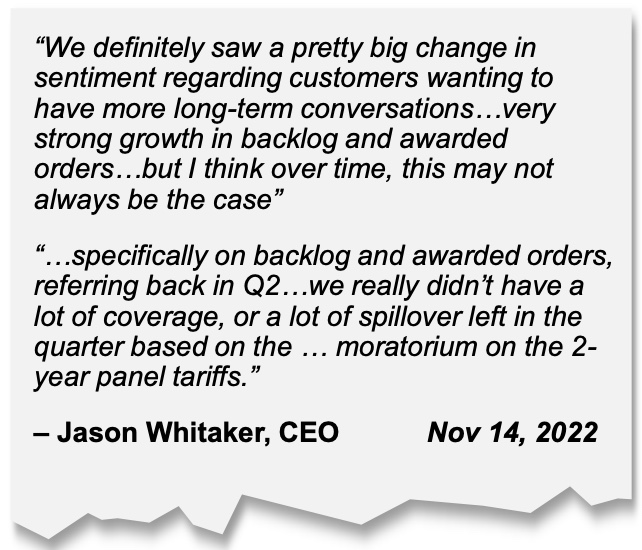

- The Company made statements regarding their backlog and awarded orders that indicate likely softening in their conversion rate over the next 12 months

- As such, I have updated my model to reflect the following:

- Conservative probability weighting on awarded order conversion over the next 12 months

- SG&A in line with increased backlog (e.g. from 2020→2021 the ratio of backlog growth to SG&A head count growth was 1:1 indicating negative operating leverage)

- I believe that Shoals will miss consensus revenue and adj. EBITDA in the first half of 2023, and the market will re-rate the business in line with their more fundamental, steady state operations:

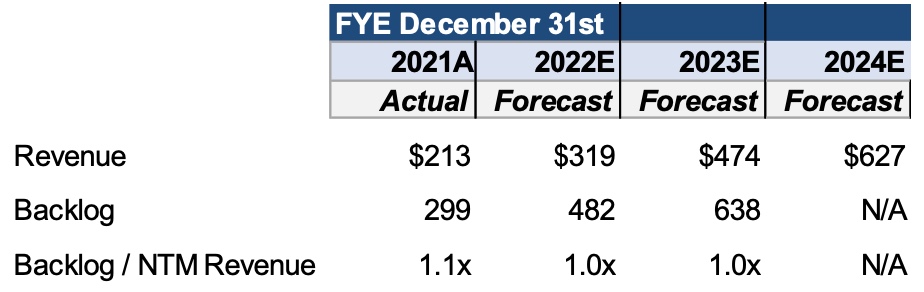

- Based on a detailed backlog analysis in the following pages, I believe Shoals will generate ~$474mm of revenue in 2023, a ~7% miss to Consensus

- SG&A to increase by ~$17mm to sustain increased order book, in line with current headcount ratios

Basis for Revision

2023 Revenue is adjusted to reflect a likely elongated sales cycle for backlog, and a probabilityweighting on awarded orders based on CEO commentary indicating future lag on book/bill ratio

- Based on December ‘21 backlog and September ‘21 backlog, the business has historically generated sales of approximately 1x backlog on an NTM basis

- This backlog figure includes awarded orders which do not have a signed contract / purchase order in place

- Based on the commentary from Shoals’ CEO, it appears that some of the backlog may be for more long-term projects

- As such, I have assumed a conservative 95% conversion rate on awarded orders in 2023 and applied historical backlog ratio against a forecasted Dec-22 backlog (assuming the same purchase order conversion as Q3, based on the CEO’s reference to Q2 spillover and future awards)

- I am assuming similar seasonality as it related to new awarded orders and the same ratio of purchase orders as a % of prior period awarded orders (conservatively in a bear case) to calculate incremental contracted revenue or “signed purchase orders”

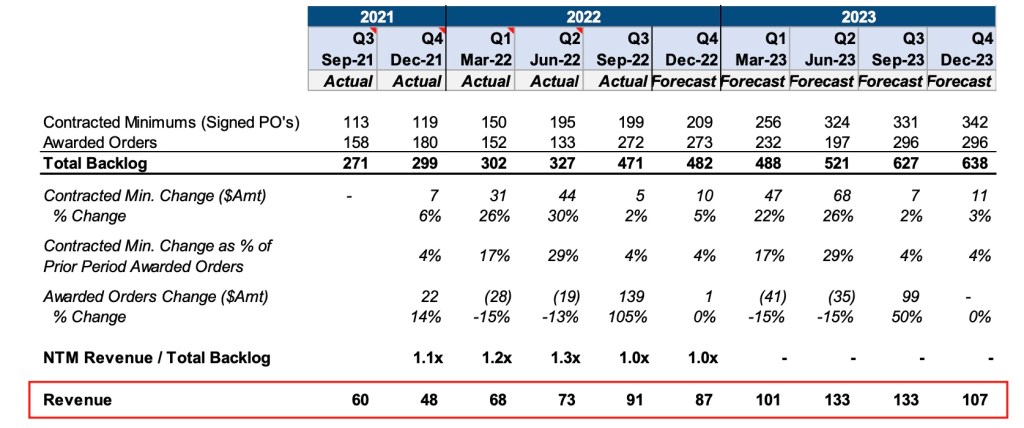

Updated Near-Term Revenue Forecast

The below forecast reflects actual Q3 2022 figures and revised Q4 2022 → Q4 2023 based on earnings release and backlog analysis

- • The below analysis assumes the change in contracted minimums (signed purchase orders) grows in line with Q3/Q2 based on CEO commentary; rest of forecast based on prior year QoQ growth rates

- Awarded orders based on prior period, adjusted to reflect conservative ~50% haircut to Q3 QoQ change based on outlier growth rate of 100+%

- Awarded orders in Q4 2022 based on median growth rate for previous 4 quarters

Forecast vs. Consensus

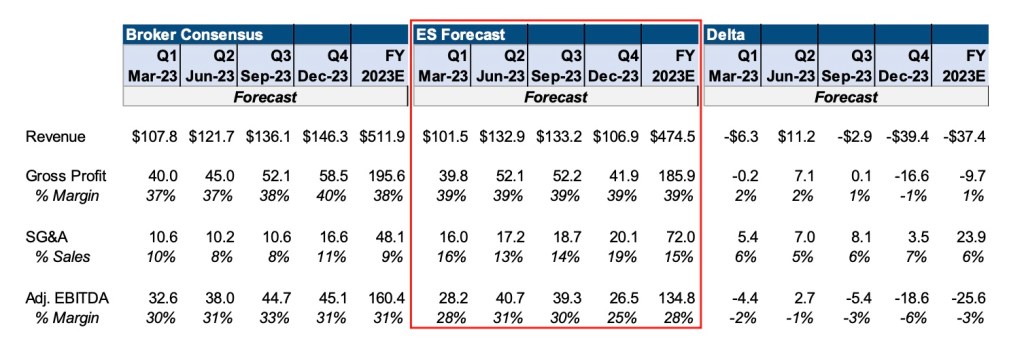

My revised revenue and EBITDA for 2023E is ~$475mm and ~$134mm, respectively, below consensus on an annual basis

- Beyond revenue, I have dialed in SG&A based on a ratio of backlog / headcount; historically, the ratio has maintained ~3.5x ratio, topping out in Q3 2022 at ~4.5x given the significant jump in awarded orders

- My forecast assumes a conservative (in a bear case) 4.0x ratio, which is 50bps higher than average over the last 8 quarters

- The company will need to decide whether to modulate their opex margins, sacrificing their top line, or build out their sales function in order to support an aggressive forecast

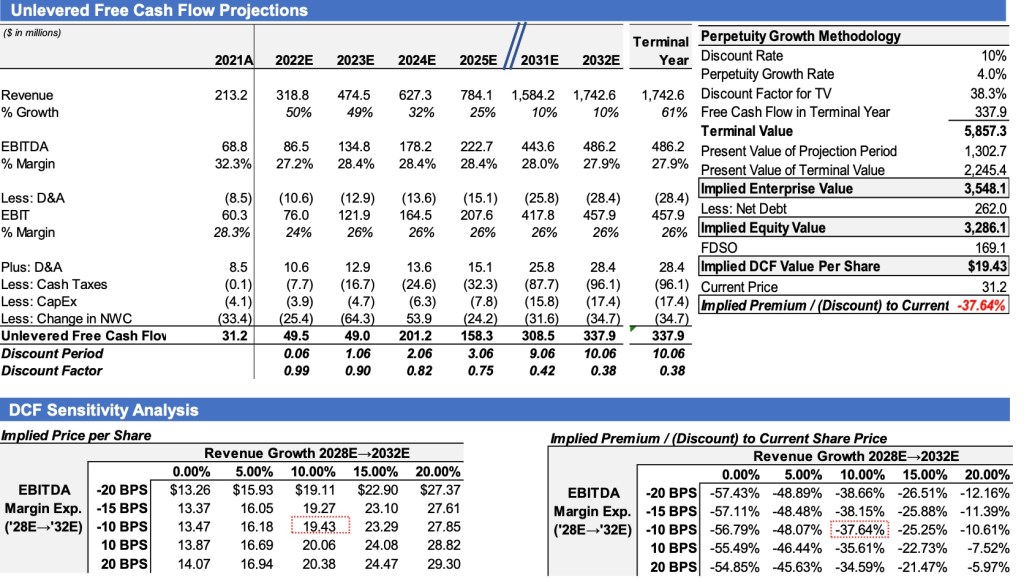

Discounted Cash Flow Analysis – 10-Year

Allowing for sustained growth over the long-term, a 10-year DCF yields a higher price/share vs. the 5-year DCF, generating a value of ~$19.43 /share, or a ~38% discount to Shoals’ current trading

Leave a comment